Gifts of Grain

Why Donate Grain?

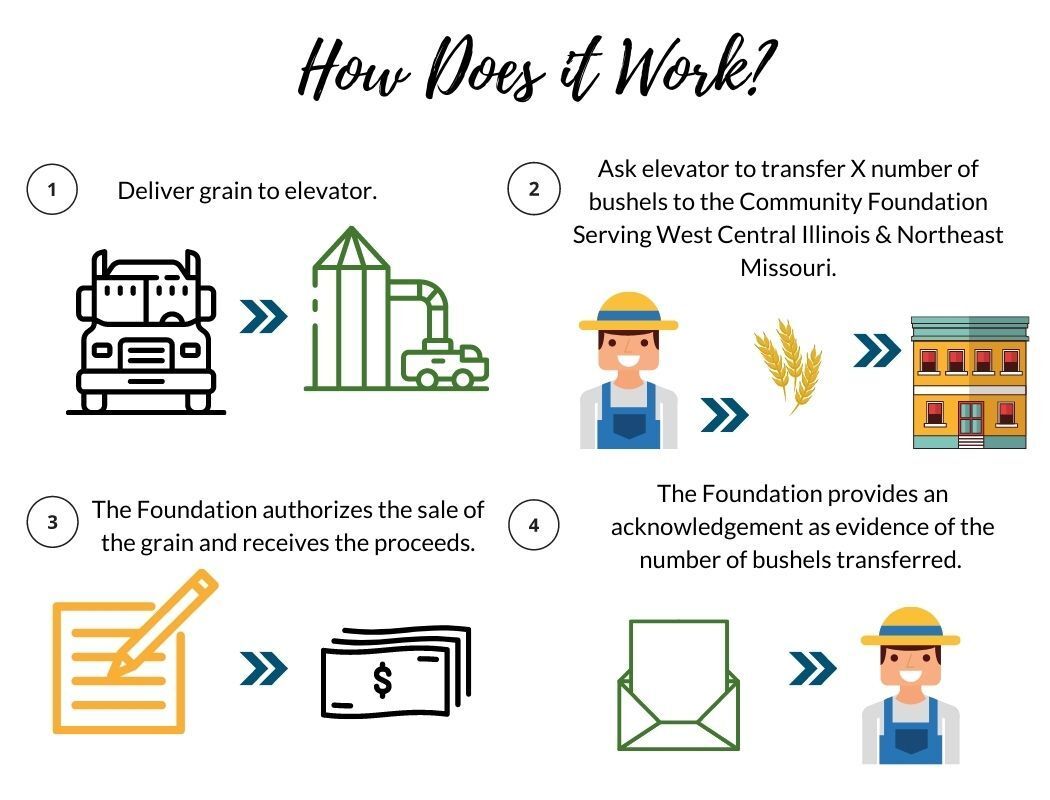

Donating a gift of grain to your Community Foundation is a simple way to make a lasting difference. The value of the grain can be used to start an endowed fund in the name of your family, for a specific nonprofit organization important to you, or to support charitable causes in your community. No matter what type of endowment you chose to establish or fund you support, you can be sure that your gift of grain is growing the future of your community.

How You Benefit

By giving grain to your Community Foundation, you avoid including the sale of the grain in your farm income. Although a charitable income tax deduction is generally not available to you, the avoidance of declaring it as income can be a significant benefit. You deduct the cost of growing the crops, which typically results in saving self-employment tax, federal income tax, and state income tax. You can benefit even if you don’t itemize your deductions and take the standard deduction.

For more information about grain gifts and instructions on how to complete them, please

contact us.

To learn more, view our

Grain Gift Brochure.

Alton Vannice was the 10th generation of his family to farm in America, learning his family’s values of progressive thinking, hard work, and determination. While learning these skills on the farm, he learned leadership skills through the Palmyra FFA Chapter and used them throughout his career, serving on numerous committees and boards. Through a gift of grain, the Alton A. Vannice Leadership Fund was established, supporting the next generation of agricultural leaders.